For most Compliance Officers, the phrase subscription document triggers an immediate association with late nights, frantic email chains, and the high-stakes pressure of fund closings. Managing the intake of subscription agreements, investor questionnaires, and the myriad of supporting schedules is rarely a linear process. It's a complex web of regulatory checks that often bottlenecks at the most critical moment. With financial institutions facing increasing scrutiny from regulatory authorities regarding accredited investor verification and AML protocols, the manual review of these documents is no longer just inefficient, it's a compliance risk.

This guide explores how AI in finance is shifting from a buzzword to a tactical necessity, transforming how compliance officers handle the chaotic influx of investor paperwork. Learn to map workflows, implement automated validation for Regulation D requirements, and build audit-ready KYC packs without increasing headcount.

Key Takeaways

Manual processing is costly: Financial institutions invest heavily in KYC compliance, with 80% employing 1,000–2,500 staff solely for these tasks.

AI handles objective validation: Automate document completeness checks, expired ID flagging, accredited investor verification, and data consistency, while humans retain judgment on nuanced risk decisions.

Measurable efficiency gains: AI reduces subscription agreement review time from 45 minutes to under 10 minutes, and KYC processing time by 66%.

Governance is non-negotiable: Every AI decision must be logged with immutable audit trails. Design workflows with human checkpoints for regulatory examination defensibility

Adoption is accelerating: 67% of institutions already use AI for compliance validation, and 62% expect widespread adoption within three years.

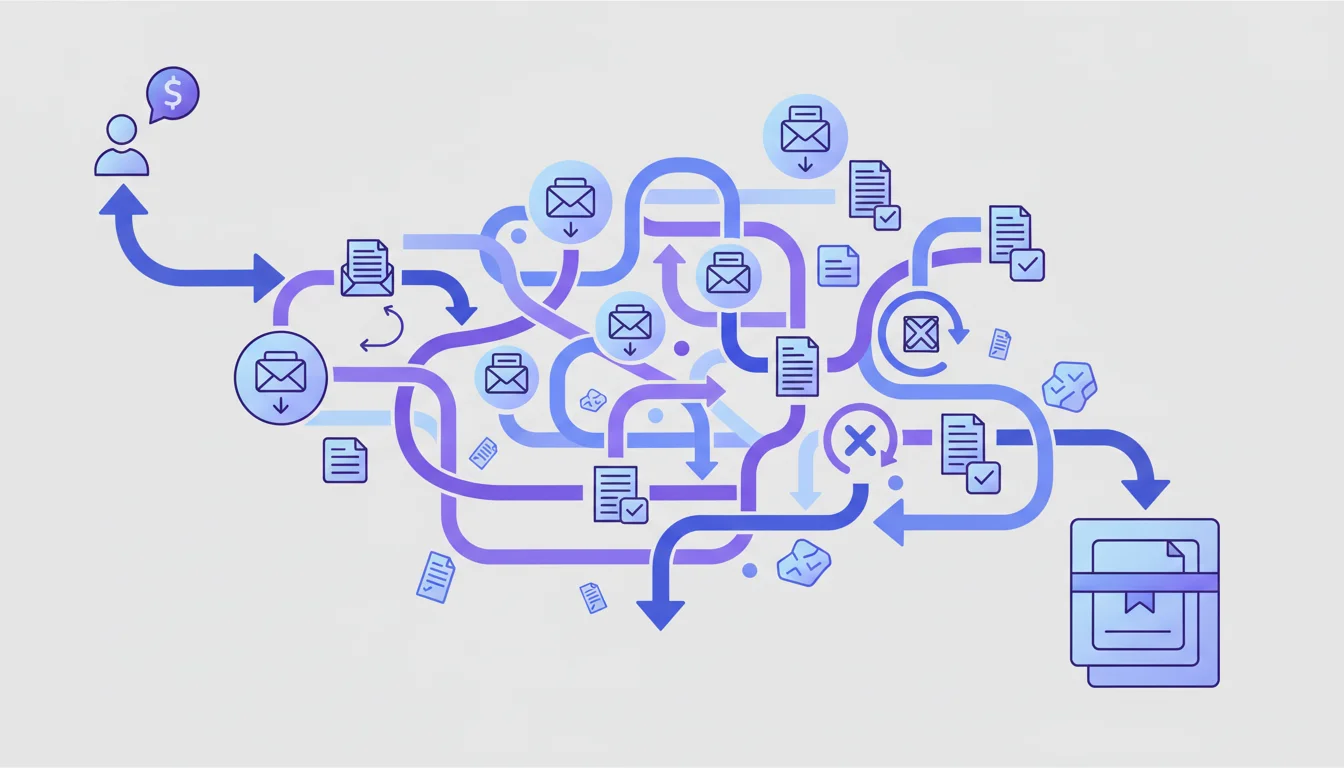

The Subscription Document Chaos Every RCCI Knows Too Well

In the private funds sector, the subscription document is the definitive record of an investor's commitment, yet it remains the single largest friction point in the closing process. A typical package includes the subscription agreement itself, an extensive investor questionnaire, tax forms (W-9/W-8), and complex Know Your Customer (KYC) documentation. For compliance officers, the challenge isn't just the volume, it's the variability. Picture this: 11 PM emails containing scanned passports that expire in three days, partial beneficial ownership charts marked with "TBD," and institutional investors attempting to use outdated templates from a prior vintage fund.

This chaos has a quantifiable cost. The pressure from deal teams to "just get it done" often conflicts directly with the meticulous review required to ensure regulatory standing. The manual nature of this work forces highly paid compliance professionals to function as data entry clerks, cross-referencing PDFs against spreadsheets. This isn't just frustrating, it's financially devastating and operationally risky.

This chaos has a quantifiable cost. The pressure from deal teams to "just get it done" often conflicts directly with the meticulous review required to ensure regulatory standing. The manual nature of this work forces highly paid compliance professionals to function as data entry clerks, cross-referencing PDFs against spreadsheets. This isn't just frustrating, it's financially devastating and operationally risky.

The Cost of Manual Compliance

The inefficiency of manual reviews is staggering. Research shows that KYC requirements demand massive operational resources, and more than 80% of financial institutions employ between 1,000 and 2,500 staff solely for these tasks.

Where the Process Breaks Down

The fundamental problem is that subscription documents arrive as unstructured data but must be converted into a structured, audit-ready dataset under impossible timelines. The friction points are consistent across firms, creating predictable pain during every closing cycle:

Inconsistent Formats: Data arrives in mixed formats (handwritten PDFs, DocuSign exports, and high-resolution image scans) that defy standard OCR tools.

Data Fragmentation: Conflicting information often exists across the KYC sources; an entity name on a certificate of incorporation may slightly differ from the one on the subscription agreement.

Client Friction: 48% of banks globally have lost clients due to slow or inefficient onboarding processes.

Version Control Nightmares: Investors signing outdated templates create cascading errors that surface only days before the final close.

Compliance has always been a cornerstone of trust and stability in regulated industries like banking, insurance, fintech, and payments.

Chaitanya Sarda, CEO at AiPrise Inc Financial Columnist

Understand What AI Can (and Cannot) Automate in Subscription Document Processing

To effectively deploy AI, compliance officers must distinguish between science fiction and enterprise reality. In the context of a regulated subscription document, AI is not about replacing judgment, it's about automating the validation of objective facts. Modern AI solutions can perform intelligent data extraction from varied formats, handling the "dirty work" of pulling investor names, commitment amounts, and tax IDs from static PDFs. This allows compliance professionals to focus on nuanced risk assessments rather than clerical validation.

AI Capabilities in Regulated Contexts

What AI Can Automate | What Requires Compliance Officer Judgment |

|---|---|

Flagging expired passports or driver's licenses immediately upon upload. | Determining if a specific "red flag" on a background check is material enough to reject an investor. |

Matching accredited investor qualification boxes against Regulation D criteria. | Interpreting complex trust structures where beneficial ownership is ambiguous legally. |

Comparing data consistency (Name/Address) across 5 different documents. | Managing the sensitive relationship with a strategic LP who refuses to provide standard docs. |

Extracting commitment amounts, wire instructions, and entity details from varied formats. | Negotiating exceptions for strategic investors who require bespoke subscription terms. |

AI excels at tasks that require high attention to detail over large datasets, exactly the tasks where human fatigue leads to errors. For instance, AI and machine learning can improve accuracy and reduce the need for human input in document organization processes. This doesn't eliminate the compliance officer's role; it elevates it to strategic decision-making.

The Security Distinction

A critical concern for US compliance teams is data residency and security. Unlike consumer AI tools, enterprise-grade AI for finance must ensure audit trails and explainability. The system can't be a "black box" algorithm that rejects a high-net-worth investor without documentation. Every decision must be traceable, defensible, and aligned with the firm's risk tolerance and regulatory requirements.

Expert Insight

Automation of AI processes is an essential tool in improving the final results of KYC, but it must be deployed within a framework of governance.

Generative AI specifically improves accuracy and enhances risk assessments in KYC compliance, but it must operate within strict boundaries defined by the firm's risk appetite and regulatory obligations.

Map Your Current Subscription Document Workflow and Identify Automation Opportunities

Before implementing software, document the anatomy of the current chaos. Start by tracing the lifecycle of a subscription document from the moment an investor expresses interest to the final creation of the closing binder. This map usually reveals that the process is not a straight line, but a series of loops, email handoffs, and manual checks. Understanding these patterns is essential for identifying where automation delivers the highest return on investment and reduces the most painful bottlenecks.

High-Impact Automation Targets

Initial Document Intake: How do documents enter the system? If it's via email attachments, this is the first failure point. Automating intake ensures documents are routed correctly immediately, eliminating the chaos of misplaced files.

Data Extraction: Are analysts manually typing data from the subscription agreement into the CRM? This is a prime target for OCR and NLP (Natural Language Processing) automation that can extract fields with minimal error rates.

Cross-Referencing: Manually checking if the entity name on the W-9 matches the subscription agreement? Automated cross-referencing can expedite verification and reduce operational costs significantly.

Document Completeness Checks: Identifying missing pages, unsigned signature blocks, or incomplete schedules before sending follow-up requests to investors.

The financial scale of this inefficiency is massive. Financial institutions spent approximately $37.1 billion on AML-KYC compliance functions recently. By identifying patterns that create chaos (such as version control failures where investors sign the wrong template), compliance teams can prioritize automations that reduce closing-week panic and improve investor experience.

The journey towards compliance often begins with understanding the intricate web of requirements for various certifications.

Pro Tip: Prioritize Completeness

Focus first on automations that check for document completeness (missing pages, unsigned signature blocks). This solves the "back-and-forth" email fatigue that frustrates investors most and creates the longest delays in closing timelines.

Is manual data entry slowing down fund closings?

dibby provides enterprise-grade AI workflows designed specifically for regulated industries. Automate subscription document processing and reduce error rates today.

Implement AI-Powered Validation for Subscription Agreements and Investor Documentation

Once the workflow is mapped, the next step is deploying AI to validate the data within the subscription agreement itself. This goes beyond simple text recognition; it involves configuring semantic rules that understand US regulatory requirements. The system must recognize not just what data exists, but whether that data satisfies specific compliance standards for accredited investors, entity formation, and KYC completeness.

Automated Intake Configuration

Configure the AI layer to ingest documents in any format: Word, PDF, or scanned image. The system should automatically identify the document type and extract critical fields including investor legal name, investment amount, entity type (LLC, LP, Trust), and signing authority. Currently, 67% of financial institutions are already using AI-driven tools for validating compliance documentation to some extent. This extraction eliminates the manual transcription errors that plague traditional workflows.

Configuring Regulatory Authority Checks

Program specific validation rules that mirror the manual checklist and key terms of compliance review:

Accredited Investor Verification: The AI scans the investor questionnaire to ensure the selected qualification (e.g., net worth over $1M) aligns with the supporting evidence provided.

Consistency Checks: The system compares the investor's name on the signature page against the entity documents and the W-9. If "LLC" is missing in one document but present in another, the system flags it immediately.

Signature Authority: Verifying that the person signing has the documented title (e.g., "Managing Member") to bind the entity according to formation documents.

Date Logic: Ensuring signature dates don't precede document dates and that commitments align with fund closing deadlines.

Handling Exceptions

When the AI identifies a discrepancy, it shouldn't just fail; it should trigger an exception workflow. For example, if a passport is expired, the system routes the issue to a junior analyst with a draft email to the investor already prepared. This allows teams to integrate their own proprietary risk models, tailoring compliance checks to their specific thresholds and investor profiles.

Measurable Impact

Automated validation reduces the average review time per subscription agreement from 45 minutes to under 10 minutes, allowing compliance teams to process significantly more volume during closing periods without sacrificing accuracy.

Automate KYC Pack Assembly and Beneficial Ownership Verification

The compilation of KYC packs is often the most labor-intensive portion of onboarding. AI can drastically reduce the time spent chasing documents by predicting exactly what is needed based on the investor's profile. Instead of generic document requests that create confusion, intelligent systems tailor requirements to the specific entity structure, jurisdiction, and risk profile declared in the subscription document.

Structured Automated Collection

Instead of sending a generic list of requirements, AI can analyze the entity structure declared in the subscription document. If the investor is a Cayman Islands exempted limited partnership, the AI automatically requests the specific formation documents required for that jurisdiction. This precision reduces the friction of asking for irrelevant documents and accelerates the collection timeline. In practice, AI has been shown to reduce KYC application processing time by 66%.

Beneficial Ownership Mapping

Unraveling complex ownership structures is a major headache for compliance teams. AI agents can parse through Articles of Incorporation and Trust Agreements to visually build ownership trees. The system identifies the Ultimate Beneficial Owners (UBOs) who meet the 25% threshold (or the firm's specific risk threshold) and highlights any gaps in the chain. Key capabilities include:

Multi-Layer Analysis: Tracing ownership through multiple holding companies and jurisdictions to identify true beneficial owners.

Gap Identification: Flagging missing documentation in the ownership chain before the file reaches final review.

Risk Scoring: Assigning risk levels based on ownership complexity, jurisdictional risk, and PEP (Politically Exposed Person) exposure.

Key Benefit: Proactive Expiration Monitoring

AI doesn't sleep. It can automatically track expiration dates for every document in the vault (passports, good standing certificates, AML letters) and send alerts 30, 60, or 90 days in advance. This eliminates the last-minute scramble to update a file before an audit.

Once validated, the AI can assemble the final package, applying standardized naming conventions and generating a completeness certification. This ensures that when a regulator asks for a file, there's a uniform, perfect pack ready for review. AI enhances these processes by automating data analysis and fraud detection, making compliance more efficient and defensible during examinations.

Maintain Governance, Audit Trails, and Continuous Improvement in Your AI Workflow

Adopting AI in a regulated environment is as much about governance as it is about efficiency. Define clearly which decisions the AI makes autonomously and which require human sign-off. This "human-in-the-loop" approach is essential for satisfying regulatory examinations and internal audits. Without proper governance frameworks, even the most sophisticated AI implementation creates more regulatory risk than it solves.

Governance and Audit Trails

Every action taken by the AI (extraction, flag, validation, and approval) must be logged with immutable audit trails. If an AI agent flags a potential sanctions match that a human officer subsequently dismisses, that decision and the officer's reasoning must be permanently recorded. This documentation is critical during regulatory examinations when examiners need to understand the basis for acceptance decisions. 84% of professionals in risk and compliance see significant benefits from using AI tools when these governance structures are in place.

Strategic Review Points

Design the workflow with mandatory checkpoints that ensure quality control and regulatory defensibility:

Random Sampling: A senior compliance officer reviews 5-10% of "auto-approved" documents to ensure model drift hasn't occurred and accuracy remains high.

Exception Review: All high-risk flags (e.g., PEP matches, negative news, sanctions exposure) are routed to a human specialist with contextual information for informed decision-making.

Periodic Assessments: Quarterly reviews of the AI's logic to ensure it aligns with any new regulatory guidance (e.g., changes to accredited investor definitions or updates to Regulation D).

Model Validation: Annual third-party assessments of AI accuracy and bias to satisfy model risk management requirements.

Measuring Success

Document wins quantitatively: time savings per closing, percentage decrease in incomplete submissions, and reduction in regulatory findings. These metrics justify continued investment and demonstrate ROI to senior leadership.

With 62% of firms expecting AI to be widely adopted in compliance workflows within three years, establishing a robust governance framework now puts firms ahead of the curve. Early adopters benefit from refined processes and proven defensibility when competitors are still experimenting.

By automating the friction-heavy elements of subscription document processing, compliance officers can reclaim their time for high-value risk assessment rather than data entry. The transition to AI-driven compliance is not just about speed; it's about creating a defensible, consistent, and audit-proof closing process. This transformation allows compliance teams to handle greater volume during peak periods without sacrificing accuracy or regulatory standing.

Ready to modernize the compliance workflow? Explore how dibby helps regulated industries streamline document processing with enterprise-grade security and customizable AI workflows tailored to fund administration and private markets.

Frequently Asked Questions

Last updated: Dec 4, 2025

Co-founder of dibby, helping financial institutions automate complex workflows with AI. Seasoned private-equity professional who managed billions across European and US strategies before moving into product and AI. Focused on turning real operational pain points into robust, enterprise-ready automation.