In 2025, AI in private equity has moved beyond theoretical discussions to become a fundamental driver of competitive advantage. For private equity analysts, the shift isn't just about faster data processing. It's about fundamentally altering how investment theses are formed, risks are assessed, and value is created. In an environment where traditional multiples are squeezed and exit horizons are shortening, using artificial intelligence for decision-making is no longer optional. It's the dividing line between firms that lead and those that lag. This guide explores how AI is reshaping the entire PE lifecycle, from sourcing to exit, and provides actionable insights on implementing these tools within the strict governance frameworks of US finance.

What Is AI in Private Equity Decision-making?

Core Definition

AI in private equity refers to the application of machine learning (ML), natural language processing (NLP), and predictive analytics to augment human judgment in investment workflows. It transforms unstructured data, from legal docs to alternative market signals, into actionable decision intelligence.

Beyond Basic Analytics

While traditional data analytics focuses on describing what happened in the past, artificial intelligence private equity applications are distinct in their ability to predict future outcomes and automate complex cognitive tasks. This is not merely about faster Excel macros. It involves sophisticated algorithms that can digest millions of data points to identify non-obvious patterns that traditional methods miss entirely.

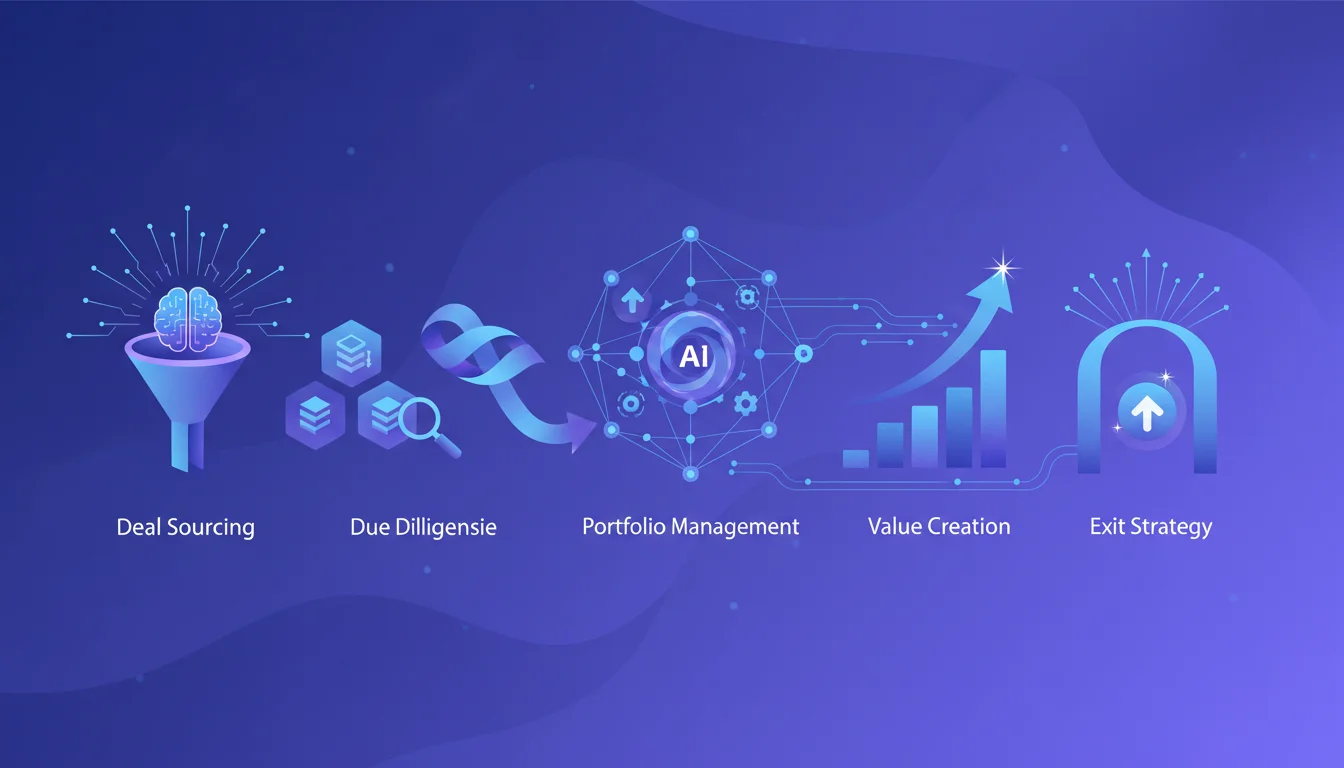

The scope of AI in this sector includes several distinct capabilities:

Deal Sourcing Algorithms: Scanning private markets for signals that precede a sale process, often months before a teaser hits the market.

Due Diligence Automation: Using NLP to ingest thousands of virtual data room (VDR) documents, identifying risks in contracts, IP portfolios, and compliance records instantly.

Value Creation Intelligence: Deploying machine learning private equity tools within portfolio companies to optimize pricing, supply chains, or customer acquisition strategies.

Augmentation, Not Replacement

A common concern surfaced in industry forums (such as discussions on whether firms should "pay for AI for investment team" budgets) is the fear of displacement. However, the prevailing model in 2025 is augmentation. AI handles the "brute force" analysis of structured and unstructured data, freeing analysts to focus on relationship building, negotiation strategy, and qualitative judgment that machines can't replicate.

A leading PE firm focused on investment targets and developed an AI tool to evaluate potential investments at increased speed and confidence.

Tribe AI source

This shift from reactive analysis to predictive AI decision-making finance allows firms to simulate thousands of scenarios during the diligence phase. It provides a level of conviction that manual modeling simply cannot match, especially when evaluating complex operating environments or non-linear growth trajectories.

Why AI Is Transforming Private Equity Investment Decisions

The Speed and Precision Edge

The competitive pressure in the US middle market is intense. Firms using data-driven PE investments are seeing tangible operational gains. In 2024, 90% of PE firms had anticipated AI to disrupt the sector. The transformation is driven by the sheer speed advantage: algorithms can screen initial deal flow 60-80% faster than human teams, allowing analysts to kill bad deals early and focus deep diligence efforts on high-probability targets.

Navigating Market Pressures

In 2025, CFOs and investment committees face mounting pressure to stay exit-ready despite volatility. The AI competitive advantage finance offers is critical here. Firms without these capabilities risk a "selection bias" where they only see the deals that broader auctions bring them, missing proprietary opportunities that AI-driven signals could identify weeks or months earlier.

Democratizing Deep Intelligence

Historically, the largest firms had an information advantage simply due to the size of their networks. Private equity AI adoption is leveling this playing field. Small and mid-sized firms can now access deep market intelligence by scraping web traffic, employee sentiment data, and supply chain signals to reduce information asymmetry that once favored mega-funds.

Enhanced Risk Mitigation

Perhaps the most critical "why" for risk-averse investment committees is compliance and error reduction. AI doesn't get tired at 2 AM during a deal sprint, and it doesn't overlook critical details in document 847 of a data room.

Red Flag Identification: AI parses financial statements and legal disclosures to flag anomalies that might indicate fraud or operational weakness.

Regulatory Consistency: Automated workflows ensure that every deal goes through the exact same compliance checks, creating a robust audit trail for investors and regulators.

Pattern Recognition: Machine learning models identify subtle warning signs in deal structures that even experienced professionals might miss under time pressure.

Funding firms that can harness AI to optimize revenue management will have a major edge.

Kearney source

Real Examples of AI Impact Across the PE Investment Lifecycle

Deal Sourcing & Screening

The traditional funnel involves manually reviewing hundreds of CIMs (Confidential Information Memorandums). In contrast, AI deal sourcing tools can continuously scan 100,000+ companies, tracking signals like hiring velocity, patent filings, or web traffic spikes to predict growth trajectories before they become obvious to the broader market.

For example, firms are using custom ML models to identify "lookalike" targets: companies that share the underlying success characteristics of a firm's previous home-run exits, even if they operate in different adjacent verticals. This approach uncovers hidden gems that traditional screening methods would filter out.

Due Diligence Automation

During the sprint to sign, speed is currency. AI due diligence automation has compressed timelines significantly. Where legal teams once spent weeks manually reviewing thousands of contracts, modern NLP engines can extract key clauses (change of control, indemnity, termination rights) in hours, not days.

Efficiency Gain

Research indicates that AI-driven tools speed up the underwriting process, making it as routine and standardized as legal diligence while maintaining accuracy.

Portfolio Value Creation

Once the deal is closed, the focus shifts to PE operational improvements AI. Firms are deploying AI "swat teams" into portfolio companies to drive measurable performance gains across multiple dimensions.

Revenue Optimization: Implementing dynamic pricing models in B2B portfolio companies that respond to market conditions in real-time.

Cost Reduction: Using predictive maintenance in manufacturing assets to reduce downtime and extend equipment life.

Performance Benchmarking: A large global PE firm now uses AI to automate monitoring and benchmarking across its entire portfolio, spotting underperformance instantly.

Customer Intelligence: Analyzing customer behavior patterns to improve retention and identify upsell opportunities before competitors do.

Exit Optimization

AI exit strategy optimization is the final lever in the value creation toolkit. Algorithms analyze market conditions to predict the optimal quarter for an exit, considering factors like sector sentiment, comparable transaction multiples, and buyer appetite trends. They also identify potential buyers by mapping strategic fits based on the acquirer's recent patent activity or M&A history, moving beyond the obvious list of usual suspects.

Real-world traction is visible in funding news, such as Beacon Software's substantial raise to fund AI-driven roll-ups, signaling that the market is betting big on this technology's ability to create value throughout the investment lifecycle.

Accelerate Your Diligence Process

Analysts are often bogged down by manual document review that consumes time better spent on strategic analysis. dibby automates the extraction and validation of critical data from financial and legal documents, ensuring decision-making is fast, accurate, and compliant.

Explore dibby for Private Equity

Implementing AI in Regulated Private Equity Environments

The Compliance-First Necessity

US private equity firms operate under strict regulatory scrutiny (SEC, FINRA). AI compliance private equity strategies must prioritize governance from day one. Firms cannot simply feed confidential CIM data into open public models like ChatGPT without risking severe data leakage and compliance violations that could trigger regulatory action.

Implementation requires "explainability mandates": investment committees must understand why an algorithm flagged a company as a buy. Black-box decision-making is rarely acceptable in regulated finance, where accountability and audit trails are non-negotiable.

Ensuring AI models and their work are transparent and auditable has to be a priority.

Tribe AI source

Integration and Data Strategy

A major hurdle is connecting regulated finance AI implementation with legacy tech stacks. PE firms often sit on silos of data: CRM entries, past deal models, and third-party data feeds that don't communicate with each other. Breaking down these silos is essential before AI can deliver its full value.

Implementation Phase | Typical Workflow | Key Challenge |

|---|---|---|

Pilot (Low Risk) | Document extraction from standardized forms (NDAs, tax returns) | Accuracy validation |

Expansion | Deal scoring and initial screening automation | Data quality & completeness |

Scaling | Predictive portfolio optimization & automated reporting | Integration with legacy ERPs |

Secure, Specialized Platforms

This is where platforms like dibby become essential. Unlike generalist tools, specialized platforms offer enterprise AI security finance teams require to meet regulatory standards. They provide customizable workflows for document processing and risk assessment that are designed specifically for regulated environments. Features like audit preparation and data validation are built-in, ensuring that PE AI governance standards are met without slowing down the deal team.

The Human-in-the-Loop Model

Successful AI workflow integration PE requires a cultural shift beyond just technology deployment. The most effective model is "human-in-the-loop," where AI handles data processing and pattern recognition, but senior analysts provide the final strategic judgment. This addresses the forum concern about "building vs. buying": smart firms buy secure infrastructure (like dibby) but build proprietary models on top of it to maintain their unique investment edge.

Pro Tip

Start with low-stakes, high-volume tasks like initial document review or data extraction. Build confidence in the system before deploying AI for critical investment decisions.

The Future of AI-Driven Decision-Making in Private Equity

Emerging Capabilities in 2025 and Beyond

The future of AI private equity is moving rapidly toward agentic workflows. The industry is seeing the rise of generative AI PE applications that can draft first-pass investment memos, simulate competitive scenarios, and even conduct autonomous market research without constant human supervision.

Predictive Evolution: Moving from "What happened?" to "What if?" scenario planning. AI agents will autonomously monitor markets for specific investment signals, alerting partners only when a thesis is validated.

Specialization: The market will likely split between generalist firms and those with deep, vertical-specific AI capabilities that allow them to underwrite risk better than anyone else in a specific niche.

Real-Time Intelligence: Continuous monitoring systems that track portfolio company performance metrics in real-time, flagging deviations from plan immediately.

Existential Requirement

The narrative of "how private equity survives AI" is shifting to "how private equity survives without AI." By 2025, the AI competitive advantage investing gap will be too large to bridge with manual labor alone. Firms that fail to adopt these tools will face structurally higher operating costs and lower returns, making them uncompetitive in fund-raising and deal competition.

Regulatory Watch

Expect increased regulatory scrutiny on predictive analytics PE tools. The SEC is already signaling interest in how algorithmic decisions impact market fairness. Firms must prepare for compliance requirements around algorithmic transparency.

Strategic Imperatives for Analysts

For the individual analyst, the mandate is clear: develop AI literacy. The value delivered is no longer in the ability to build a pivot table at 3 AM, but in the ability to interpret AI trends private equity 2025 and apply judgment to machine-generated insights. Analysts should look to partner with compliant AI platforms to automate the drudgery of their work, positioning themselves as high-value strategic thinkers who can bridge technology and investment expertise.

Firms that embrace AI early will have a competitive advantage.

HBR source

The integration of AI private equity is not a distant future. It is the current reality of high-performing firms in 2025. By automating diligence, enhancing sourcing with predictive signals, and enforcing strict governance, AI empowers analysts to make faster, higher-conviction investment decisions. The firms that win in the next decade will be those that successfully marry human judgment with machine intelligence, creating a competitive moat that manual processes simply cannot replicate.

Ready to modernize investment workflows with enterprise-grade security? Explore how dibby helps private equity teams automate document processing and compliance risk analysis with human-in-the-loop oversight.

Frequently Asked Questions

Last updated: Dec 4, 2025

Co-founder of dibby, helping financial institutions automate complex workflows with AI. Seasoned private-equity professional who managed billions across European and US strategies before moving into product and AI. Focused on turning real operational pain points into robust, enterprise-ready automation.